Practice Exam Questions

Case for cutting the National Debt (Revision Essay Plan)

- Level:

- A-Level

- Board:

- AQA, Edexcel, OCR, IB, Eduqas, WJEC

Last updated 4 May 2019

Here is a developed answer to this question: "With reference to a country of your choice, assess the case for a government setting fiscal policy to reduce the size of the national debt."

Analysis and application point 1

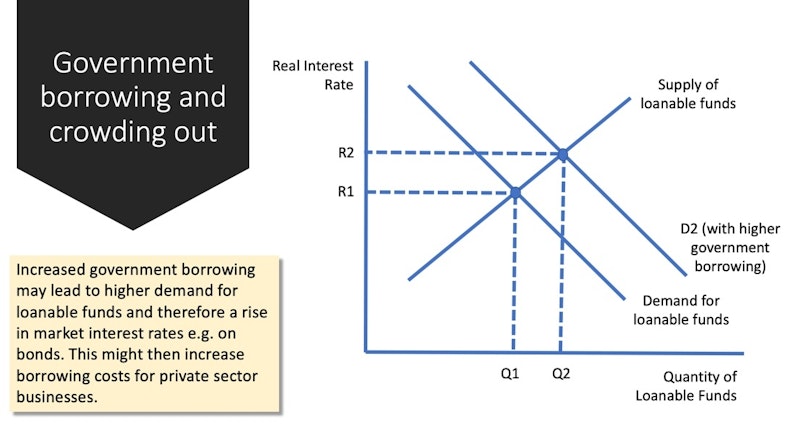

National debt is the accumulated debt of the government and state-owned enterprises yet to be repaid. The stock of debt has risen in many countries. In 2018,Japan had a gross national debt of 237% of GDP, Greece 174% and Italy 133% contrasted with Germany (56%) and the UK (87%). One reason why a government might target a fiscal surplus in a bid to reduce the national debt is that rising debt can lead to slower economic growth. This can be explained in part by “crowding out theory”which argues that increased government spending & borrowing then increases the supply of bonds, driving bond prices lower and leading to higher interest rates in the market for loanable funds. If interest rates rise, then this might cause a contraction in planned capital investment by private sector businesses because borrowing costs have become more expensive. As a result, weaker investment causes a fall in aggregate demand and also has a negative effect on a country’s productive capacity and trend growth. Cutting the national debt and improving the government’s credit rating might therefore help keep interest rates lower and help encourage consumption & investment from the private sector.

Evaluation point 1

Although the national debt has increased in many countries including the UK and Japan, it is important to assess the underlying causes. For the UK for example, much of the steep increase in debt from 2010 through to 2016 happened because of the bail-out of some banks and also a decision by the UK government to allow the automatic stabilisers of fiscal policy to work during the post-crisis recession. Without that initial fiscal stimulus, alongside deep cuts in monetary policy interest rates, there was the real risk of a deflationary depression in the UK. There is no automatic relationship between the size of national debt and a country’s GDP growth prospects. Indeed, Keynesian economists argue that state borrowing to fund infrastructure whilst adding to debt in the short run – helps improve trend growth and will create extra tax revenues in the medium term.

Analysis and application point 2

A second argument in favour of fiscal austerity policies designed to control borrowing and eventually cut the national debt is that very high levels of debt cost billions of extra pounds in interest payments as the debt is serviced. In the US for example, the annual interest on the debt is nearly $500 billion. In the UK, with national debt approaching 90% of GDP, around 5% of government spending goes on interest payments which amounts to over £800m a week. Fiscal conservatives believe that this imposes a large opportunity cost on the Government since there is less available to spend on education, health and other public services. They also argue that, if the debt was lower, not only would interest payments fall, but that in the medium term, scaling back the debt allows for reductions in direct and indirect taxes which will then have a positive effect on aggregate demand and long-run aggregate supply. Fiscal conservatives favour a smaller state with much less government spending, borrowing and debt.

Evaluation point 2

Although in theory higher national debt imposes a big financial burden on the government, in practice the UK government effectively pays some of this to itself since around a quarter of government debt is owned by the Bank of England because of their policy of quantitative easing (QE). The scale of debt payments also depends on the yield on government bonds, and in the case of the UK and Japan, the current nominal yield on ten year debt is less than 2 percent. This means that – in real terms – the real interest rate on new debt is effectively zero. In this situation, Keynesian economists critique the idea of crowding out and counter argue that increased investment in social house, transport and healthcare has a strong fiscal multiplier effect which generates higher incomes and tax revenues in the future, thereby cutting debt.

Final conclusion

The government owes £1.8 trillion, up from about £1 trillion in 2009/10. Debt is stabilising at around 85% of UK GDP. How strong is the case for cutting government spending or raising taxes to reduce the size of the debt? A high level of debt could be a problem if bond yields for the UK start to rise again but in my opinion this is unlikely in the current environment. Perhaps a disorderly Brexit might cause the sterling exchange rate to depreciate sharply and cause bond market investors to become nervous. But in reality, yields have been low for a long time and three quarters of the UK national debt is owned by insurance companies, commercial banks, pension funds and the Bank of England. They get the interest and much of that money remains in the circular flow and in helping to fund pensions. High national debt is not inevitably a barrier to achieving good macroeconomic outcomes.

You might also like

External Debt Relief

Study Notes

Relevance of Keynesian Economics

17th October 2014

Estonia - Growth and Development

Study Notes

Fiscal Policy (Revision Presentation)

Teaching PowerPoints

Multiplier, Accelerator and Keynesian Economics (Revision Presentation)

Teaching PowerPoints

Fiscal Policy - Government Borrowing

Study Notes