Study Notes

Challenger Brands and Contestable Markets

- Level:

- AS, A-Level, IB

- Board:

- AQA, Edexcel, OCR, IB, Eduqas, WJEC

Last updated 28 Jan 2020

Challenger brands are products and businesses with the potential to upset the apple cart by disrupting the models and market power of established firms.

Across many sectors, with each passing year we see the coming (and going) of challenger brands. Challengers often target specific demographics in an industry such as younger consumers. Some are more successful than others, indeed a handful become market leaders in their own right because they are able to scale quickly to bring down their unit costs and build a commercially viable revenue stream.

Others make sizeable losses and test the resilience and the pockets of shareholders. Many disappear almost as soon as they arrive.

Some successful challenger brands are targets for an acquisition. Recall some years back the arrival of Innocent Smoothies (owned since 2013 by Coca Cola) and Green and Black chocolate (now owned since 2005 by Cadbury’s). In February 2019, Unilever the consumer goods conglomerate bought the hit snack food business Graze.

Challenger brands are a feature of a process of creative destruction (a term coined by Joseph Schumpeter of the Austrian school of economics). Challenger brands often make effective use of digital / social media to make an impact without spending vast sums on advertising and marketing. Viral marketing techniques can be hugely effective.

Here are some examples of challenger brands in different sectors. When there is an inflow of fresh competition and the threat of other rivals entering an industry, then a market becomes more contestable. This then can impact on the behaviour of existing firms many of whom may have enjoyed market power for a lengthy time period.

Retail commercial banking

Traditionally dominated by giants such as HSBC, Barclays and Lloyds. Challenger banks include Metro Bank and Monzo. TSB might also be seen as a challenger after their de-merger from Lloyds.

Find out more about challenger banks in this article: https://www.bankingtech.com/2018/05/uk-challenger-banks-whos-who-and-whats-their-tech/

Cinemas

Netflix has certainly become a global challenger to the revenues and profits of cinema chains such as Odeon, Cineworld and Vue. Everyman Cinemas might also be seen as a challenger to existing players. Disney has launched their own streaming platform.

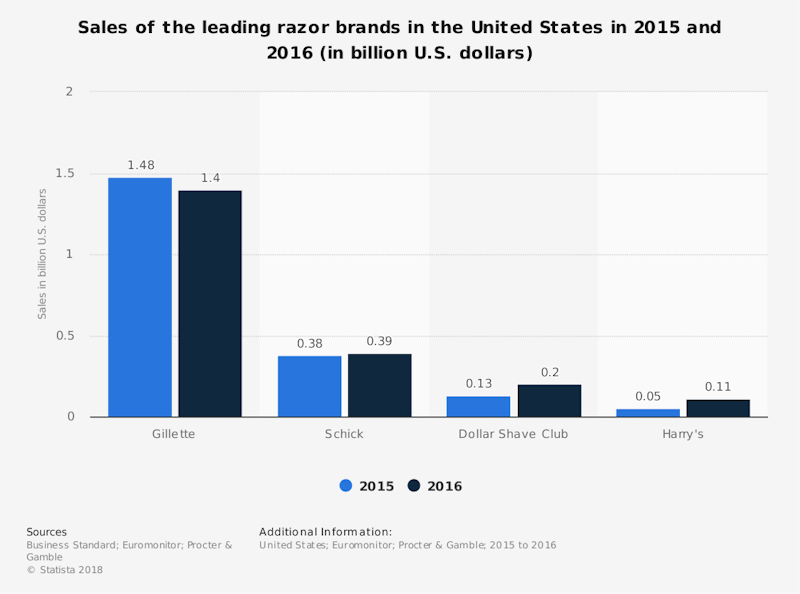

Shaving products

For decades, the shaving products industry has been dominated by Gillette (owned by Proctor and Gamble) and Wilkinson Sword (owned by Shick). But in recent years a number of challengers have appeared including the UK’s King of Shaves and Dollar Shave Club.

Alcohol

Traditionally seen as an oligopolistic industry with high barriers to entry, the brewing sector is being challenged by the rise to prominence of a number of craft beer manufacturers some of whom have already been swallowed up through acquisition. The Scottish craft beer brewer Brewdog (founded in 2007) is a good example. They are scaling up production and have opened a huge new factory in Ohio, USA along with their own chain of pubs. But Brewdog remains many times smaller than the nearest competition among the giant beer manufacturers.

Sipsmith (gin) and Fever Tree (tonic water) are great examples to use of challenger brands that have done more than a little to upset the status quo in their respective sectors.

Estate agents

The safe, untroubled world of estate agencies which for many years has been dominated by businesses such as Savilles, Foxtons and Countrywide is being disrupted as they lose market share to online competitors such as Purple Bricks.

Read more here. https://www.independent.co.uk/news/business/news/uk-estate-agents-thrrat-sales-profit-property-housing-market-london-slump-a8210421.html

The term ‘challenger brand’ was first coined in 1999 by Adam Morgan, founder of strategic brand consultancy firm Eatbigfish

Household energy suppliers

For many years, the supply of electricity and gas to millions of households has been dominated by suppliers such as British Gas, EDF Energy, E.ON, nPower, Scottish Power and SSE. Challenger brands has gained some traction - among them Ovo Energy, Co-Op Energy and First Utility. That said we have also seen in recent weeks and months the collapse of a clutch of very small energy suppliers. Edinburgh-based Our Power had just 38,000 customers when it went out of business in January 2019. Ivo Energy recently bought SSE to become one of the top six energy suppliers in the UK market.

Commercial bank lending

One challenger to traditional forms of borrowing from commercial banks such as HSBC and Barclays is the rapid growth of peer-to-peer lending platforms such as Funding Circle, RateSetter. In total they remain very small in contrast to the value of loans issued by the big banks but they are worth investigating as an example. Read more about peer to peer lending here: https://www.moneywise.co.uk/investing/peer-to-peer/peer-to-peer-can-you-really-get-returns-10

Retail grocery

One of the big stories over the last decade or so has been the fast-growth of the deep discounters such as Aldi and Lidl putting increasing pressure on dominant retailers such as Tesco, Sainsburys and Asda. Amazon purchase Whole Foods and it will be interesting to see whether Whole Foods is able to make a sizeable dent in the market share of retail grocers that target higher-income households.

Read more:

Financial Times (2018): Consumer goods: big brands battle with the ‘little guys’

https://www.ft.com/content/4aa58b22-1a81-11e8-aaca-4574d7dabfb6

You might also like

Costs Revenues and Profits - Key Terms

Study Notes

Streaming and the Music Industry

30th July 2015

Stellios opens his easyFoodstore with 25p offers!

2nd February 2016

Test 17: MCQ Revision on Production and Cost for A Level Economics

Practice Exam Questions

Contestable Markets: The Battle for Dominance in Cloud Gaming

6th February 2020

Short Run and Long Run Costs - Selection of Revision MCQs

Practice Exam Questions