Practice Exam Questions

A* Exam Technique: Evaluating impact of a higher minimum wage

- Level:

- A-Level, IB

- Board:

- AQA, Edexcel, OCR, IB, Eduqas, WJEC

Last updated 8 Jun 2020

In this revision video we look at a suggested exam answer to a question on the impact of a significant rise in the minimum wage on the UK economy.

Here is the question we look at:

Assess the argument that both the short and long-term performance of the UK economy will be helped by a significant increase in the minimum wage. (25)

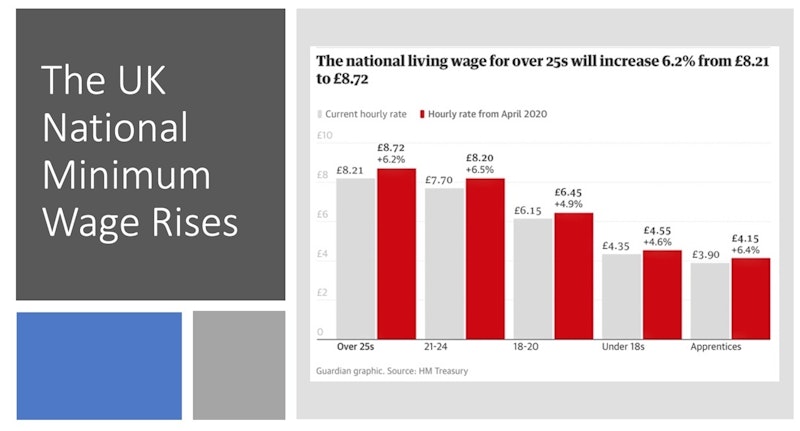

KAA Point 1:

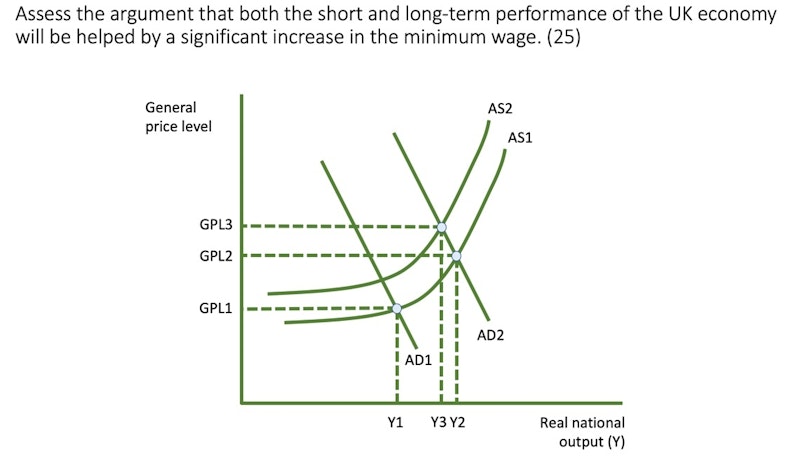

In the short term, Keynesian economists argue that a 6% rise in the nominal value of the minimum wage provides a stimulus to consumer spending, AD and hence to real GDP growth in the UK. This is because a higher pay floor will lift gross weekly earnings of people in relatively low paid jobs such as catering assistants, care workers and hundreds of thousands with retail jobs. Families on low disposable incomes tend to have a higher marginal propensity to consume. A 61p rise in the NMW could increase wages by £90 a month or around £1,000 a year. If extra income was spent, this could then cause an outward shift in AD and provide a fillip to UK GDP growth which has slowed below 2% since 2014 in part due to Brexit uncertainty. Some families might choose to save any gain in income which is important given the low household saving ratio which currently below 5% of disposable income. Or they might use some of the extra money to pay off unsecured debts which often carry a high rate of interest and which penalize vulnerable households on low monthly incomes.

Evaluation Point 1

A counter argument is that raising the national minimum wage by 6% in nominal terms is unlikely to provide a significant short-term lift to aggregate demand. This is becausesome employers - perhaps smaller retail businesses where wages are a high percentage of total costs - may reduce the number of hours offered to the employees in a bid to control costs. A drop in average hours worked will then limit the earnings available for people in low paid work. Linked to this is evidence that a sizeable proportion of people on or at the minimum wage remain in working poverty and must claim universal credit. A higher minimum wage could lead to some claw-back in welfare payments thereby reducing the positive impact on monthly disposable incomes. And if a higher minimum wage also leads to an increase in cost-push inflation (shown in my analysis diagram by an inward shift of short run aggregate supply), then rising consumer prices will mean a 6% nominal rise in the minimum wage is less generous when expressed in real terms at constant prices. If inflation rises to 3% (above target), a 6% nominal increase is only a 3% real terms increase.

KAA Point 2:

Some economists argue that raising the minimum wage can benefit the UK in the long-term by improving productivity growth and also planned business capital investment. The efficiency wage theory argues that paying workers above low free market levels gives employees a psychological lift and incentivizes more people to engage in active job search. A higher legal pay floor creates a wedge between incomes in work and welfare benefits during times of economic inactivity. This could then cause the labour supply to expand. And it might also encourage a stronger flow of inward migration of workers into industries where there are labour shortages such as health care, construction, hospitality and tourism.If labour supply and output per worker rise, this causes an outward shift of long run aggregate supply and helps the UK achieve stronger trend growth which in turn will raise living standards. Higher aggregate demand lifted by rising real wages, will then stimulate an increase in business investment according to the accelerator theory in sectors such as retail and leisure.

Evaluation Point 3:

However, there are fears that a significant hike in the minimum wage might lead to higher operating costs for businesses, causing a drop in profits which then leads to a reduction in planned capital investment and jobs. The British Chambers of Commerce has argued that successive increases in the minimum wage could lead to businesses cutting back on training which in the medium-term could hold back productivity growth. Not all businesses are able to pass on higher costs to their consumers, especially when market demand is price elastic and there are intense competitive pressures from overseas rivals. Much depends on the extent to which other costs might be falling – for example retail stores might be able to negotiate lower rents – or perhaps a counter-vailing reduction in corporation tax or national insurance payments for businesses could help moderate the impact of the minimum wage rise. In the long run, opponents of a minimum wage rise claim that some businesses will outsource more of their production overseas where labour costs are lower, but it is often hard to see which industries this applies to in a UK context.

Final Reasoned Comment / Judgement:

Unemployment in the UK is at a 45-year low of 3.8% of the labour force and inflationary pressures in the labour market and the wider economy remain subdued with nominal wage growth under 3% and consumer prices rising by less than 2% annually. Employment rates are at a record high, but real wages have remained stagnant for more than a decade and a sizeable percentage of households with at least one person in a job are classified as being in working poverty. Although there are some risks from lifting the minimum wage well above inflation, my view is that the medium-term benefits are more persuasive. The government can move to lower costs in other areas including reforms to business rates and rents and thousands of businesses already recognise that paying workers an equitable wage for an hour’s work is both fair and makes commercial sense. Over 6,000 employers such as Ikea, Aldi and Everton FC have committed to paying a voluntary real living wage of £9.30 outside London and £10.30 inside the capital. The long-term health of the UK economy depends on making work pay and lifting productivity. A higher minimum wage can help to achieve both.

You might also like

Macroeconomic Objectives and Conflicts (Revision Presentation)

Teaching PowerPoints

UK Economy in 2015 - Exam Revision Webinar

Topic Videos

The impact of structural unemployment

26th November 2015

Starter activity on analysis skills - "This is because"

11th December 2016

Economies of Ale - Changes to the UK Pub Industry

27th November 2018

Huge rise in the claimant count as recession bites

20th May 2020

Update on the UK Economy - October 2022

24th October 2022