In the News

Where next for Norway's sovereign wealth fund?

21st November 2017

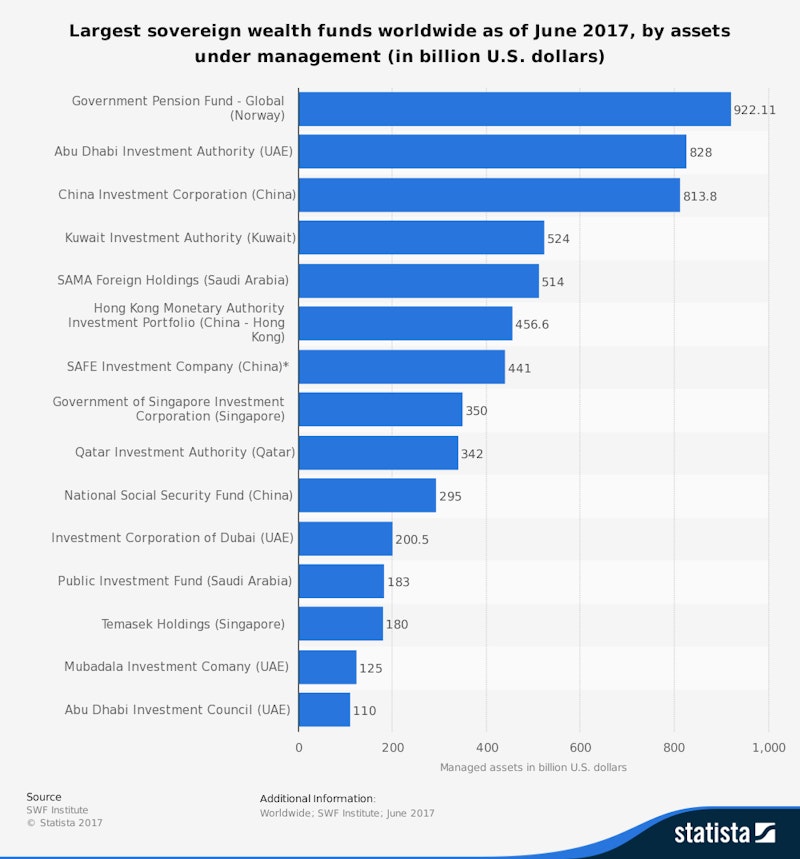

The world's biggest sovereign wealth fund (worth in excess of $1trillion) has proposed dropping its investments in oil and gas stocks.

The Norwegian fund officially known as Government Pension Fund Global (GPFG) is run by the Norwegian Central Bank and is designed - in large part - to help diversify the risks facing the Norwegian economy over the longer term and in particular, dependency on revenues from oil and gas exploration, production and refining.

It comes as something of a surprise that 6% of the fund is currently held in oil and gas equities! But there is no denying the significance of the fund in global stock markets and many analysts will be looking carefully to see in which direction the fund moves when reallocating their portfolio.

Is this a lead indicator of a tipping point for investment in conventional energy supplies?

Sovereign wealth funds are state-owned (the UK does not have one and perhaps we should have created one when North Sea production was at a peak). The invest in a broad array of financial assets including stocks, bonds, real estate and even investments in globally-traded precious metals.

As Norway sells out of oil, suddenly fossil fuels are starting to look risky https://t.co/QhOXEtUYKG

— Guardian Business (@BusinessDesk) November 19, 2017

Is Norway's wealth fund becoming too big for comfort?https://t.co/SxABlEykbD pic.twitter.com/894PaWaDBz

— Bloomberg Opinion (@opinion) November 19, 2017

The world's largest sovereign fund is considering pulling out of oil stocks https://t.co/iqgPeZ5dy9

— The Wall Street Journal (@WSJ) November 16, 2017

Norway's $1 trillion wealth fund proposes divesting oil and gas stocks https://t.co/j7sHQCWkYM pic.twitter.com/khnj3neqBL

— Bloomberg (@business) November 16, 2017

You might also like

Balance of Payments - Trade Imbalances

Study Notes

Chinese businesses winning contracts on the new Silk Road

8th September 2015

What can the iPhone tell us about China's Trade?

31st May 2016

Key Macro Topics to Revise for June 2017

17th May 2017

Inside China's Future Factory

13th January 2019

Resource Scarcity

Topic Videos

New World Bank country classifications by income level are published

10th August 2022

Manufacturing Coming Home - The Economics of Re-Shoring

13th March 2024