Study Notes

Current Liabilities

- Level:

- GCSE, AS, A-Level

- Board:

- AQA, Edexcel, OCR, IB

Last updated 22 Mar 2021

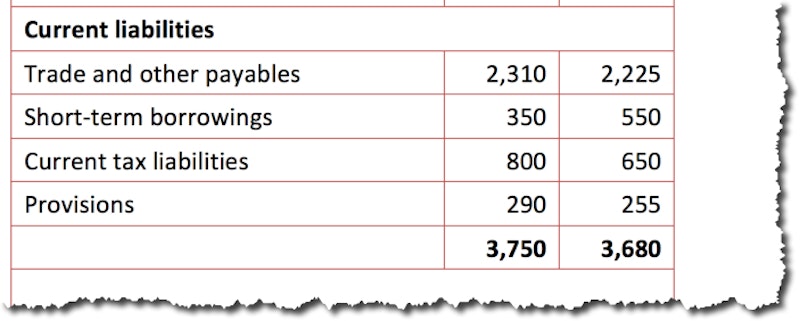

Current liabilities represent amounts that are owed by the business and which are due to be paid within the next twelve months. Current liabilities are normally settled from the amounts available in current assets.

The main elements of current liabilities are:

Trade and other payables

The main element of this is normally "trade creditors" – amounts owed by a business to its suppliers for goods and services supplied. A trade creditor is the reverse of a trade debtor. A business buys from a supplier and then pays for those goods and services some time later – the period depends on the length and amount of credit the supplier allows.

Short-term borrowings

Amounts in this category represent the amounts that need to be repaid on outstanding borrowings in the next year. For example, a business may have a bank loan of £2 million of which £250,000 is due to be repaid six months after the balance sheet date. In the balance sheet, the bank loan would be split into two categories: £250,000 as short-term borrowings and the remainder (£1,750,000) in the borrowings figure in non-current liabilities.

Current tax liabilities

This category shows the tax liabilities that the business is still to pay to the government. This will mainly comprise corporation tax, income tax and VAT.

Provisions

This is a category that can contain a variety of amounts due. For example, it would include any dividends due to be paid to shareholders. More importantly, it will also include any estimates of potential costs which the business might incur in relation to known disputes or other issues. For example, if the business is subject to legal claims or is planning to make redundancies in the near future – then the likely costs of these issues needs to be provided for in the balance sheet

You might also like

Raising Finance (Revision Presentation)

Teaching PowerPoints

Introduction to Financial Statements

Study Notes

Non-Current Assets – Property, Plant & Equipment

Study Notes

Introduction to Financial Accounts (GCSE)

Study Notes

Sources of Finance: Trade Creditors

Topic Videos

AQA A Level Business - Key Resources for the New Academic Year

1st September 2017