Study Notes

Cash Flow Forecasting - Example (Startup)

- Level:

- AS

- Board:

- AQA, Edexcel, OCR, IB

Last updated 22 Mar 2021

Let's look at an example of a simple cash flow forecast for an example start-up.

Example – Sophie & Jack

Experienced interior designers Sophie and Jack decide to go into business together. They enter into a partnership, with each of them investing £5,000 into the business. Their "product" is a home-makeover service, modeled on the popular daytime television programmes where ordinary households are transformed through small building work and decoration.

Revenues:

Sophie and Jack expect to gain 2 projects per month for the first 6 months of trading; each project will generate £5,000 of sales. Customers will be expected to pay 25% of the price as a deposit with the balance on completion. Each project is expected to last one month.

The main costs associated with the start-up are:

- Equipment - £2,500 (month 1) & £2,500 in month 4), a total investment of £5,000

- Marketing - £500 per month

- Legal and accounting costs - £1,250 (month 1)

- Project materials – £1,500 per project (i.e. £3,000 per month). It is assumed that suppliers will allow Sophie & Jack 30 days to pay for these costs

- Sub-contracted labour (other tradesmen) - £4,000 per month. These will be paid in the month incurred.

- Sophie & Jack will pay themselves a salary of £1,000 each per month whilst the business is established.

- Other sundry costs of £500 per month have been assumed

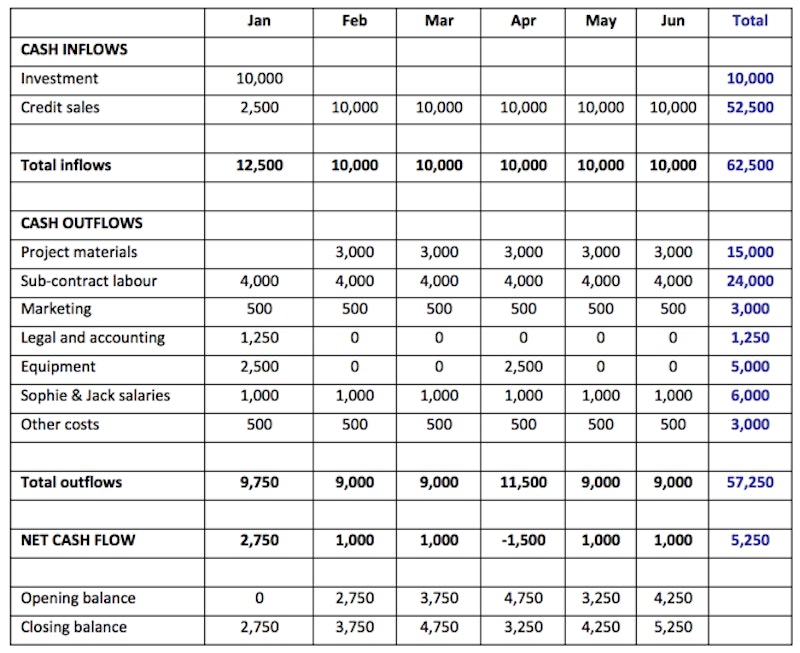

Putting these assumptions into a cash flow forecast produces the following results:

The format of the cash flow forecast above is typical of the style used by most small businesses. You may come across different layouts and headings, but don't worry. The important thing is to understand the main information contained in the forecast and to be able to analyse what the figures show.

So, let's take a look around the structure of the cash flow forecast:

Cash inflows – these are the movements of cash into the business. The investment by Sophie and Jack into the partnership is a one-off cash inflow whereas the payments by customers are regular sources of cash. The challenge for Sophie and Jack is to ensure that customers pay on time. Delayed payments, for whatever reason, can seriously affect the cash flow of a small business.

In the forecast above, the monthly cash inflows are around £10,000 p/m and total £62,500 for the first six months of trading. Note that this total for cash inflow is not the same as sales. Those cash inflows include £10,000 of investment into the partnership.

Cash outflows – these are movements of cash out of the business. An important part of estimating cash outflows is to ensure that a prudent (or cautious) view is taken about both the size and timing of payments. Have all costs been taken into account? Will suppliers really offer 30 days credit before payment is required? A sensible cash flow forecast allows for what is known as "contingencies" – i.e. unexpected costs or higher than expected payments.

Looking at Sophie & Jack's cash flow forecast, the monthly cash outflows are typically around £9,000 except for a couple of months where some investment in equipment increase the amount of cash going out of the business.

Net cash flow – this is simply the difference between the total cash inflows and the total cash outflows. Net cash flow will vary by month. When looking at a cash flow forecast in the exam, always remember to look for months in which there is a net cash outflow (i.e. a reduction in the cash balance of the business). If there is a cash outflow, the questions you should ask are:

- Does the business have enough cash left after the outflow (look at the closing balance)

- If not, does the business have access to a bank overdraft

You can see from Sophie & Jack's cash flow forecast that there is a small net cash inflow each month except in April when there is a net cash outflow of £1,500.

Net cash outflows are often caused by one-off payments (e.g. buying equipment, paying tax such as VAT) or where seasonal falls in sales mean that cash inflows are not strong.

Opening balance – this is simply the balance in the bank at the start of a period. For a start-up, the opening balance is zero. As soon as investment funds are added to the bank, then the cash flows begin! Remember that the opening balance in any one month should equal the closing balance at the end of the previous month.

Closing balance – this is the amount in the bank at the end of the month. In the BUSS1 exam, you might be asked to calculate the closing balance. The formula for the closing balance is opening balance + net cash flow.

During your studies you should try to look at several different kinds of cash flow forecast like the one above. It is important to build your confidence looking at the numbers – seeing how they are calculated and then making some judgements about what the numbers mean!

You might also like

Profit and Cash Flow - What is the Difference?

Study Notes

Causes of cash flow problems

Study Notes

Handling cash flow problems

Study Notes

Finance: Causes of Cash Flow Problems (GCSE)

Study Notes

Finance: Dealing with a Cash Flow Problem (GCSE)

Study Notes

AQA A Level Business - Key Resources for the New Academic Year

1st September 2017

Coronavirus and Cash Flow

17th April 2020