Study Notes

Profit and Cash Flow - What is the Difference?

- Level:

- AS, A-Level

- Board:

- AQA, Edexcel, OCR, IB

Last updated 22 Mar 2021

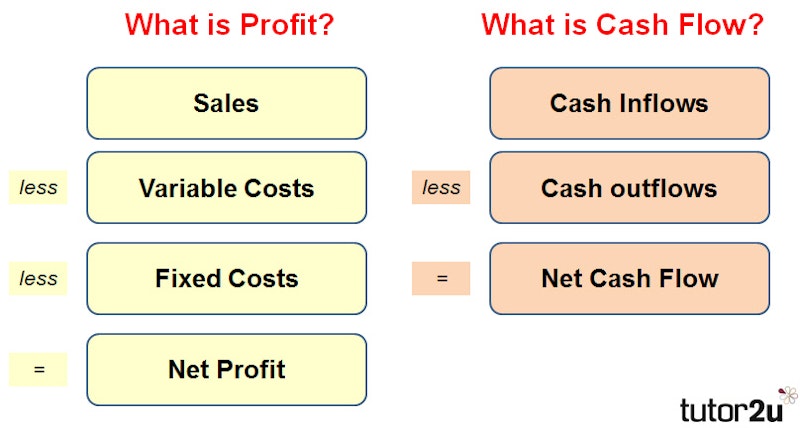

Profit and cash flow are two different calculations – as shown above.

There are two main ways in which net cash flow differs from net profit during any accounting period:

(1) Timing differences

These arise because a business may not received cash straightaway from a customer and it may also delay payment for its costs.

For example, a customer may buy goods for £50,000 but be allowed to pay for those goods in 60 days.

(2) The way that fixed assets are accounted for

Fixed assets are the assets that a business means to keep. They are treated as capital expenditure in the financial statements – that means that the cost of those assets is not treated as an operating cost. So:

- Payment for fixed asset = cash outflow

- Cost of fixed asset = treated as an asset not a cost

- Depreciation is charged as cost when the value of fixed assets is reduced

Let’s look at a few more example transactions to help make the point about how cash flow can differ from profit:

You might also like

Profit - What is it?

Study Notes

Income Statement (Revision Presentation)

Teaching PowerPoints

Finance: Dealing with a Cash Flow Problem (GCSE)

Study Notes

Liquidity Ratios (Financial Ratios Explained)

Topic Videos

Calculating and Measuring Profit

Teaching PowerPoints

FREE CPD Webinar - Making Finance Fun!

7th September 2016

Lunchtime Learning with the Calculation Practice Book!

2nd February 2018

Cash Flow Objectives of a Business

Topic Videos