Study Notes

Sources of Finance: Bank Overdraft

- Level:

- AS, A-Level

- Board:

- AQA, Edexcel, OCR, IB

Last updated 8 Aug 2019

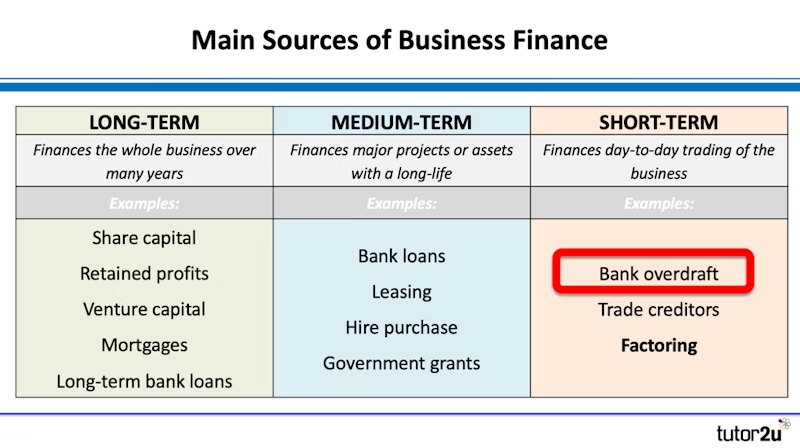

A bank overdraft is a common external and short-term source of finance for a business.

Comparison of Bank Overdrafts and Bank Loans

The key advantages of overdrafts and loans in certain business situations:

Advantages of an overdraft over a loan

- Business only pays interest when overdrawn

- Bank has flexibility to review and adjust the level of the overdraft facility, perhaps on a short-term basis

- Overdraft can be effectively be used as a medium-term loan – the facility is simply renewed each time the bank comes to review it

- Being part of short-term debt, the overdraft balance is not normally included in calculations of the business' financial gearing

Advantages of a loan over an overdraft

- Business and bank know precisely what the repayments of the loan will be and how much interest is payable and when. This makes cash flow planning more predictable

- The loan is committed – the business does not have to worry about the loan being withdrawn whilst it complies with the terms of the loan

You might also like

Sources of Finance - Venture Capital

Study Notes

Sources of Finance: Business Angels

Study Notes

Sources of Finance: Trade Creditors

Topic Videos

Sources of Finance - Hire Purchase and Leasing

Topic Videos

Gearing Up for Growth - Microsoft Sources Huge Debt Finance

4th August 2016

Sources of Finance: Debt factoring

Study Notes

Sources of Finance | Family & Friends

Topic Videos