Study Notes

Income Statement - Introduction

- Level:

- AS, A-Level

- Board:

- AQA, Edexcel, OCR, IB

Last updated 22 Mar 2021

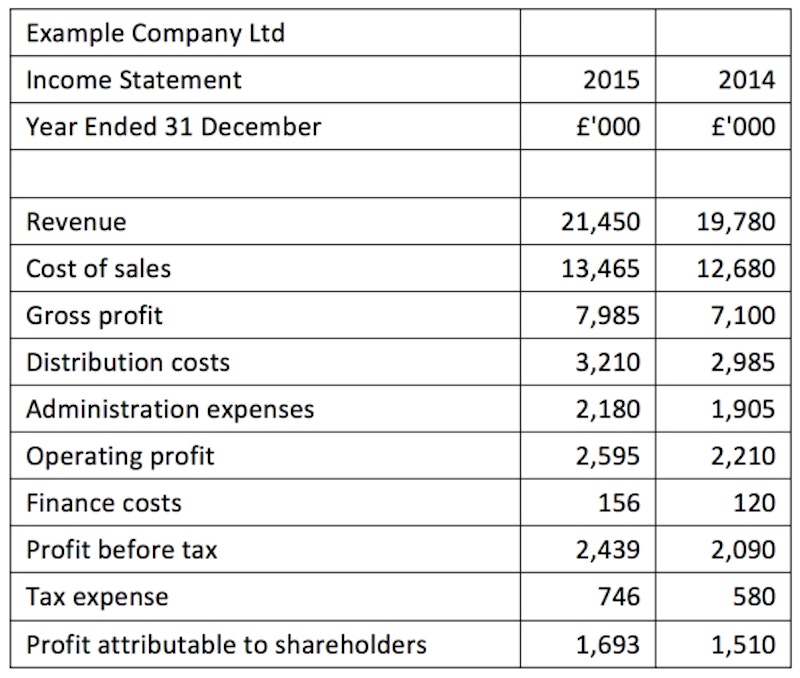

The income statement is a historical record of the trading of a business over a specific period (normally one year). It shows the profit or loss made by the business – which is the difference between the firm's total income and its total costs.

The income statement serves several important purposes:

- Allows shareholders/owners to see how the business has performed and whether it has made an acceptable profit (return)

- Helps identify whether the profit earned by the business is sustainable ("profit quality")

- Enables comparison with other similar businesses (e.g. competitors) and the industry as a whole

- Allows providers of finance to see whether the business is able to generate sufficient profits to remain viable (in conjunction with the cash flow statement)

- Allows the directors of a company to satisfy their legal requirements to report on the financial record of the business

The structure and format of a typical income statement is illustrated below:

The lines in the income statement can be briefly described as follows:

You might also like

Profit - What is it?

Study Notes

Introduction to Financial Statements

Study Notes

Improving Profit

Quizzes & Activities

Income Statements Revision Quiz

Quizzes & Activities

Next Cuts Sales and Profit Forecast – Again!

7th May 2016

Elon Musk: Man on a Mission

6th September 2016

Edexcel A Level Business - Key Resources for the New Academic Year

1st September 2017

New Edexcel A Level Business (Year 1) Numerical Assessment

13th September 2017