Study Notes

Current Ratio

- Level:

- GCSE, AS, A-Level

- Board:

- AQA, Edexcel, OCR, IB

Last updated 22 Mar 2021

What is the current ratio?

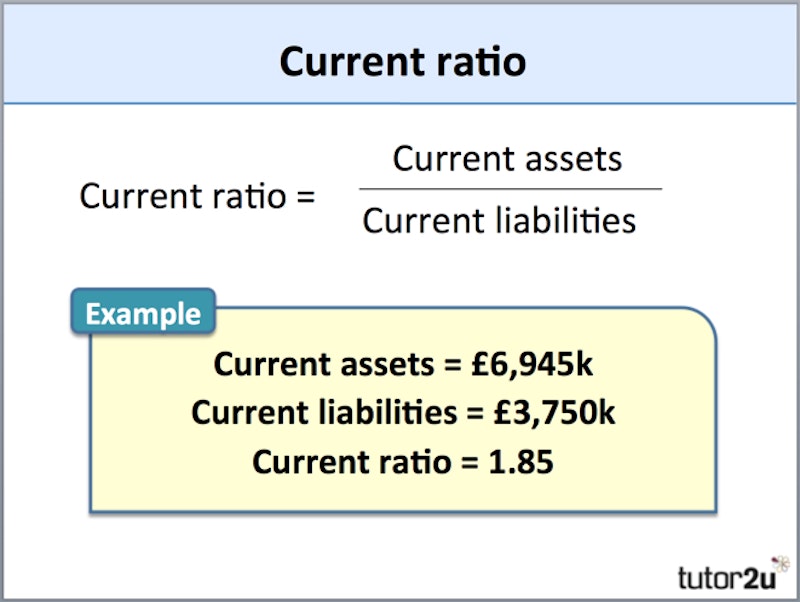

The current ratio is one of two main liquidity ratios which are used to help assess whether a business has sufficient cash or equivalent current assets to be able to pay its debts as they fall due. In other words, the liquidity ratios focus on the solvency of the business. A business that finds that it does not have the cash to settle its debts becomes insolvent.

Liquidity ratios focus on the short-term and make use of the current assets and current liabilities shown in the balance sheet.

The current ratio is a simple measure that estimates whether the business can pay debts due within one year out of the current assets. A ratio of less than one is often a cause for concern, particularly if it persists for any length of time.

A current ratio of between 1.0-3.0 is pretty encouraging for a business. It suggests that the business has enough cash to be able to pay its debts, but not too much finance tied up in current assets which could be reinvested or distributed to shareholders.

A low current ratio of less than 1.0 might suggest that the business is not well placed to pay its debts. It might be required to raise extra finance or extend the time it takes to pay creditors. However, this very much depends on the nature of the business. When evaluating the current ratio, it is important to compare with key competitors and industry averages for a better perspective on the strength or weakness of the number.

Perhaps more significant would be a sharp decline in the current ratio from one period to the next, which may indicate liquidity issues.

If you would like to learn more about this topic then have a look at out key topic video!

You might also like

Working with Suppliers - Tesco Eases Supplier Cash Flow Pain

6th October 2015

Supply Chains & Suppliers

Quizzes & Activities

Cash flow Management - Improving Cash Flow

Topic Videos

Lunchtime Learning with the Calculation Practice Book!

2nd February 2018

Limited and Unlimited Liability

Topic Videos

Inventory Management

Study Notes