Study Notes

Creditor (Payables) Days

- Level:

- GCSE, AS, A-Level

- Board:

- AQA, Edexcel, OCR, IB

Last updated 22 Mar 2021

The Creditor (or payables) days number is a similar ratio to debtor days and it gives an insight into whether a business is taking full advantage of trade credit available to it.

Creditor days estimates the average time it takes a business to settle its debts with trade suppliers. The ratio is a useful indicator when it comes to assessing the liquidity position of a business.

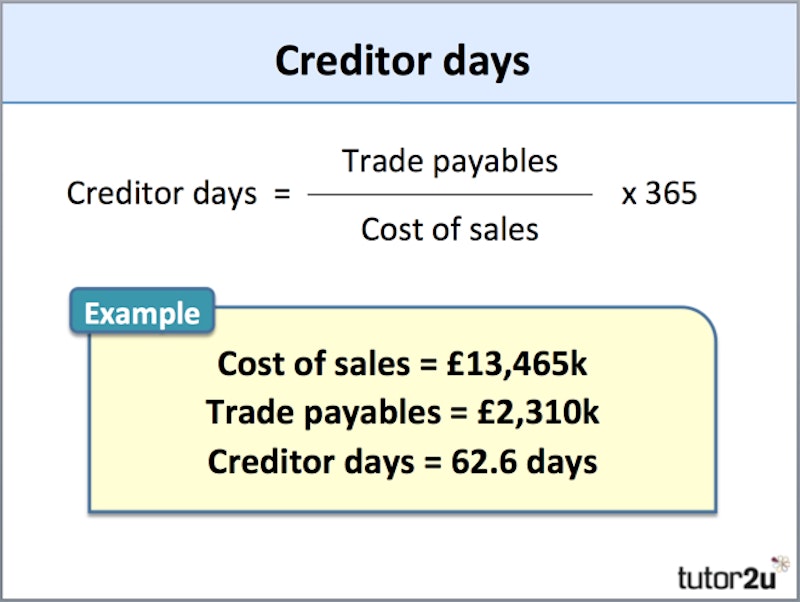

As an approximation of the amount spent with trade creditors, the convention is to use cost of sales in the formula which is as follows:

In general a business that wants to maximise its cash flow should take as long as possible to pay its bills.

However, there are obvious risks associated with taking more time than is permitted by the terms of trade with the supplier. One is the loss of supplier goodwill; another is the potential threat of legal action or late-payment charges.

You can also argue that it is ethical to pay suppliers on time, particularly if your suppliers are much smaller and rely on timely payment of their invoices in order to manage their own cash flow.

You might also like

Causes of cash flow problems

Study Notes

Finance: Leasing as a Source of Finance

Study Notes

Liquidity Financial Ratios Revision Quiz

Quizzes & Activities

Sources of Finance: Trade Creditors

Topic Videos

Cash Flow - Causes of Cash Flow Problems

Topic Videos

Inventory Management

Study Notes

Sources of Finance: Debt factoring

Study Notes