Study Notes

Business failure

- Level:

- AS, A-Level

- Board:

- AQA, Edexcel, OCR, IB

Last updated 22 Mar 2021

Business ia about risk and reward. The ultimate risk of running a business is that it fails and goes out of existence. Many businesses do fail. Why?

High Failure Rate of New Businesses

The highest rate of business failure is amongst new businesses (start-ups). It should be pretty obvious why this is the case:

- Difficult to test a business model without trading

- Easy to be over-optimistic in the business plan

- Competitor response is often aggressive

- Management may lack experience

Among the most common reasons why new businesses fail so frequently are:

- No demand for the business idea

- Poor market research & unrealistic plan

- Competitor response

- Just a bad idea – was doomed to fail!

- Good idea, but poorly executed

- Wrong people; poor management

- Growth is too quick (overtrading) or too slow

- Failure to manage cash flow

- A competitor grabs the good idea and does it better

- External shocks

- Economic change

- Legal & social change

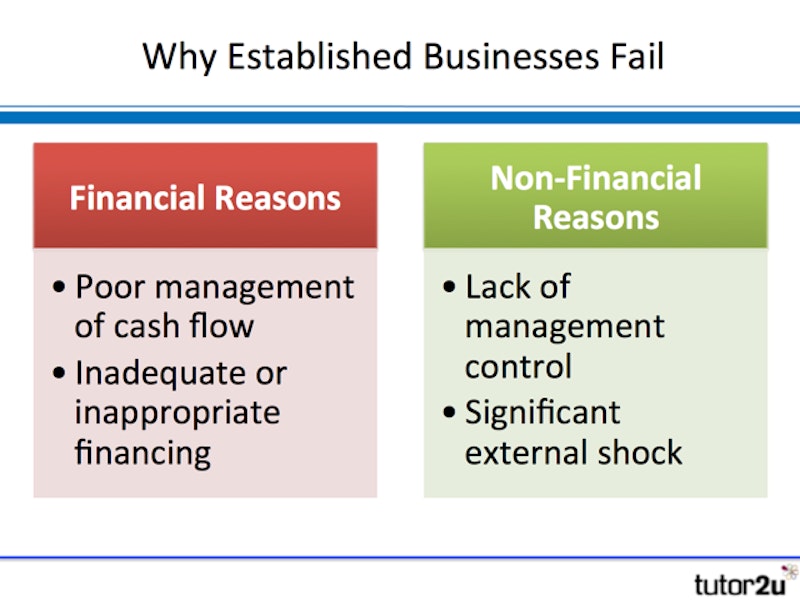

Why Do Established Businesses Fail?

The main reasons why established businesses fail can be grouped into:

The key points to remember about each of the four reasons above are:

Evidence of poor management of cash flow:

- Significant increases in stock levels

- Inadequate credit control

- Bad debts incurred

- Poor accounting practices including late invoicing

- Inaccurate forecasting by management

- Failure to plan for significant capital and/or exceptional expenditure

Evidence of inadequate or inappropriate financing:

- Use of short term overdrafts for long term investment or capital spending

- Failure to use debt factoring when sales are substantially increasing

- Inadequate shareholder capital all contribute to cash flow problems

- These problems will become more pronounced when a substantial difficulty such as a major bad debt, loss of a major customer or business interruption occurs

Evidence of lack of management control:

- Failure to develop a credible business plan

- Failure to understand costs, markets and key customers

- Failure to administer the business properly

- Caught be surprise by significant illegality or unethical behaviour leading to substantial business costs

- Excessive marketing expenditure

Evidence of significant external shocks

- Loss of important / major customer (particularly if costs cannot be reduced)

- Sudden decline in market demand

- Change in legislation impacting demand or increasing costs

You might also like

Causes of Business Failure

Topic Videos