Study Notes

Factors that can cause a change in aggregate demand

- Level:

- AS, A-Level, IB

- Board:

- AQA, Edexcel, OCR, IB, Eduqas, WJEC

Last updated 27 Oct 2020

Here are some examples of short answer paragraphs on factors that might cause a change in aggregate demand.

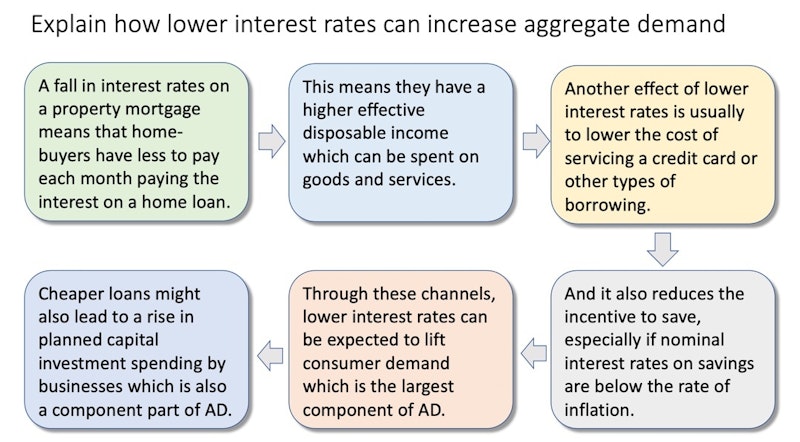

Explain how lower interest rates can increase aggregate demand

A fall in interest rates on a property mortgage means that home-buyers have less to pay each month paying the interest on a home loan.

This means they have a higher effective disposable income which can be spent on goods and services.

Another effect of lower interest rates is usually to lower the cost of servicing a credit card or other types of borrowing.

And it also reduces the incentive to save, especially if nominalinterest rates on savings are below the rate of inflation.

Through these channels, lower interest rates can be expected to lift consumer demand which is the largest component of AD.

Cheaper loans might also lead to a rise in planned capital investment spending by businesses which is also a component part of AD.

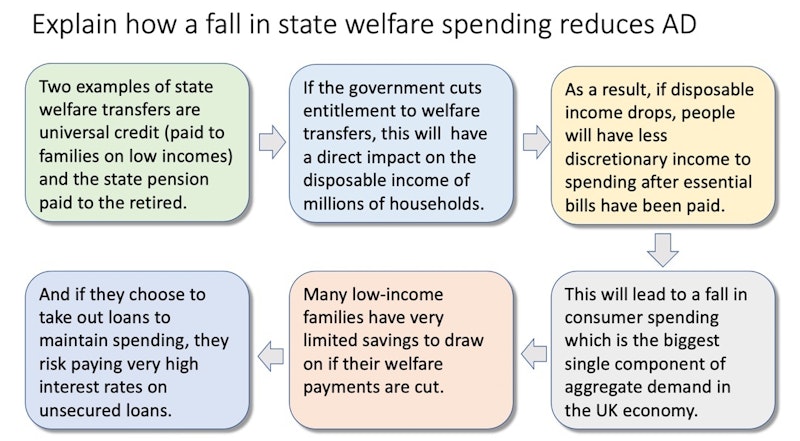

Explain how a fall in state welfare spending reduces AD

Two examples of state welfare transfers are universal credit(paid to families on low incomes) and the state pension paid to the retired.

If the government cuts entitlement to welfare transfers, this will have a direct impact on the disposable income of millions of households.

As a result, if disposable income drops, people will have lessdiscretionary income to spending after essential bills have been paid.

This will lead to a fall in consumer spending which is thebiggest single component of aggregate demand in the UK economy.

Many low-income families have very limited savings to draw on if their welfare payments are cut.

And if they choose to take out loans to maintain spending, they risk paying very high interest rates on unsecured loans.

Explain how a drop in business confidence can affect AD

Business confidence reflects expectations about future sales,revenues, costs and profits. Keynes labelled these “animal spirits.”

A drop in business confidence might be caused by the start of a recession or if a specific market experiences falling demand.

If business sentiment declines, many will choose to postpone or cancel some planned investment projects.

A fall in investment will reduce injections into the circular flow of income and lead to contracting demand for capital goods.

Thus, businesses manufacturing machinery or building newfactories will see demand for their own products falling.

As a result, aggregate demand will drop, and this might alsolead low-confidence firms to make some of their labour force redundant.

You might also like

Relevance of Keynesian Economics

17th October 2014

Aggregate Demand and Aggregate Supply Lesson Resource

22nd January 2016

Aggregate Demand Glossary

5th May 2012

Robert Shiller on Animal Spirits

10th March 2009

Measuring the Balance of Payments

Study Notes

Balance of Payments - Current Account Deficits

Study Notes

Balance of Payments - Trade Imbalances

Study Notes

Multiplier, Accelerator and Keynesian Economics (Revision Presentation)

Teaching PowerPoints