Study Notes

Business Growth - Introductory Concepts

- Level:

- AS, A-Level, IB

- Board:

- AQA, Edexcel, OCR, IB, Eduqas, WJEC

Last updated 14 Apr 2019

Core revision notes on the different pathways available for businesses to grow along with some recent examples.

BACKWARD VERTICAL INTEGRATION

This involves acquiring a business operating earlier in the supply chain – e.g. a retailer buys a wholesaler, a brewer buys a hop farm.

- Apple buying a chip supplier Dialog in 2018

- Tesco buying the wholesaler Booker for £4bn in 2018

CONGLOMERATE INTEGRATION

A conglomerate has a large number of diversified businesses

- Samsung

- General Electric

- Tata Group

- Phillips (Netherlands)

FORWARD VERTICAL INTEGRATION

Forward vertical integration involves acquiring a business further up (forward) in the supply chain – e.g. a vehicle manufacturer buys a car retail business.

- Live Nation merging with Ticketmaster

- Shell buying First Utility

- Amazon buying Whole Foods

HORIZONTAL INTEGRATION

When companies from the same industry amalgamate - firms are at the same stage of the production process e.g. two car manufacturers.

- Horizontal mergers in the betting industry: Ladbrokes and Gala Coral, Betfair and Paddy Power.

- Mergers in the brewing industry.

INTERNAL (ORGANIC) GROWTH

Organic (or internal) growth involves expansion from within a business, for example by expanding the product range, or number of business units and location.

- Domino’s Pizza (UK)

- Lego

- Walmart

JOINT VENTURE

A joint venture occurs when two or more businesses join together to pursue a common project

- Renault-Nissan

- Docklands Light Railway

- Google and NASA developing Google Earth

- Toyota and Panasonic setting up an EV battery joint venture

- IAG/American Airlines joint venture

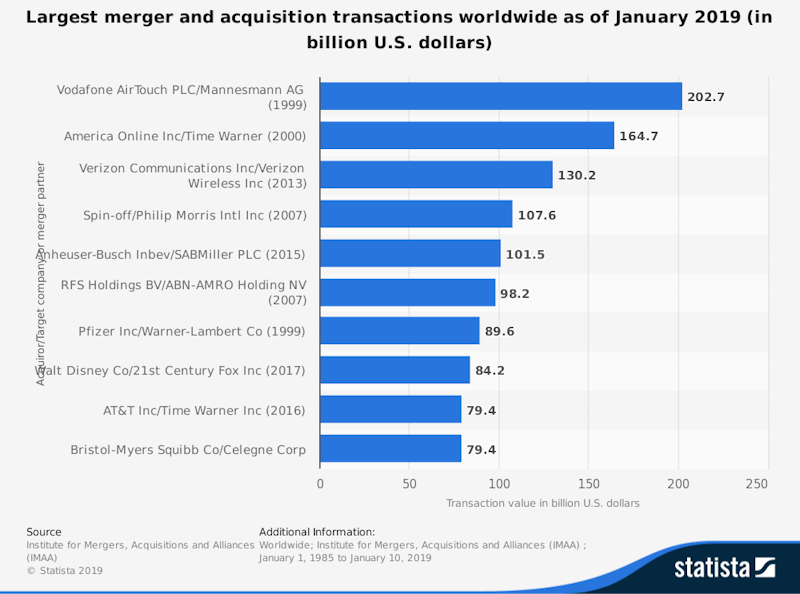

Mergers and takeovers

A merger is a combination of two companies to form a new company

A takeover, is the purchase of one company by another, in which no new company is formed.

You might also like

Evaluating Mergers and Takeovers

Study Notes

Joint Ventures

Study Notes

Explaining Business Objectives

Study Notes

Why do businesses grow?

Study Notes

Conglomerate Integration

Study Notes

Lessons on managing a fast growing business

22nd October 2014

Group think and the troubles at Tesco

1st October 2014