Study Notes

Economics of Rail Nationalisation

- Level:

- AS, A-Level, IB

- Board:

- AQA, Edexcel, OCR, IB, Eduqas, WJEC

Last updated 1 Dec 2018

Should the UK railway industry be taken back into public ownership? This revision note looks at some of the arguments for and against.

Which ownership is best for running a rail network? There has been a long-running debate in the UK about whether the rail network and train services - which at present is a mix of state and private sector control - should be brought back under public ownership via a process of gradual nationalisation.

Railways in the UK

Following privatisation under a Conservative Government in 1993, British Rail was divided into two main parts: one part being the national rail infrastructure (i.e. the track, signalling, bridges, tunnels, stations and railway depots) and the second being the operating companies whose trains run on the network.

The infrastructure is owned, maintained and operated by Network Rail which is a state-owned and "not-for-dividend" company - with the exception of the HS1 route through Kent. Profits made by Network Rail are reinvested in the network.

Rail services are run by privately-owned train operating companies. Passenger services are let as multi-year franchises by the government except in London and Merseyside (MerseyRail) where they are let as concession agreements by the relevant local body.

Background facts on the UK rail industry

- Rail passenger journeys in Great Britain have more than doubled in the last 20 years

- 64% of rail journeys start or end in London; 5.7% of morning peak rail arrivals in London exceeded train capacities which indicates the degree of over-crowding on many commuter services

- The UK rail network is one of the safest in Europe. No passengers or rail workers have died as a result of a mainline train accident in over ten years

- In 2016, franchised train companies brought in a combined income of £12.4bn, mostly from ticket fares

- Profit margins in the rail industry have declined on average, from 3.6% in 1998 to 2.9% in 2014–15

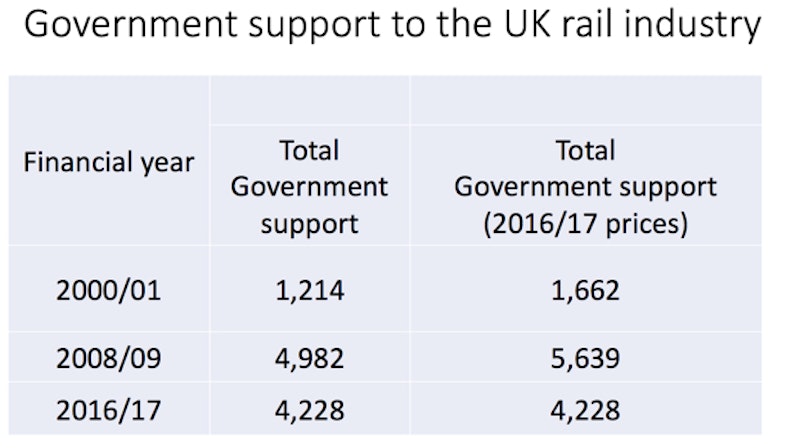

- Net government funding of the railways was £3.2bn in 2016 (excluding debt). Net funding means that the government paid £6.7bn in support to the rail industry, and received £3.5bn back

- Rail fares have gone up by an average of 121 per cent between 1995 and 2017, with long distance fares increasing the most

- Rail fares are roughly 50% higher than in 2007, compared with a 30% increase in motoring costs and a 70% increase in bus fares over the same time period. In other words, rail fares have increased in relative terms.

- The cost of peak and anytime rail tickets in Britain are some of the highest in Europe

- Passenger satisfaction has been in steady decline since the Passenger Satisfaction Survey began in 2011 in part this is the result of extensive delays on over-crowded trains but also a response to hefty rises in average fares.

- In 2018 the average fare (across both regulated and unregulated fares) rose by 3.4%

- In 2017 87% of franchised trains ran on time. The low point of the PPM was 78% in 2002 and the high point 92% in 2012

- Most European railways, including within the EU, are government-owned

The Rail Franchise System

Rail franchises

Since privatisation in the mid-1990s, there have been two types of passenger rail service on the British rail network: open access operators (i.e. those that bid for ‘slots’ – specific parts of the overall National Rail timetable – to operate their own passenger services) and franchisees (i.e. those who operate a contracted service on a particular part of the rail network under licence from the Government and the Regulator). Most services are franchisees.

What is a rail franchise?

Franchising involves the Government setting out a specification for what it would like a franchisee to do over a set period (this includes level of service, upgrades to rolling stock and ticketing technology, standard performance indicators such as service reliability). Companies then bid for the right to operate a franchise. The Government picks whichever company it thinks will deliver the best overall package for the franchise and give the best value for money. The majority of train operating companies with a franchise receive a subsidy from the government.

Open access operators (OAOs) and market contestability

There are currently just two OAOs in Britain, First Hull Trains and Grand Central Railway which represent less than 1% of the entire network but around 15% of around 180 services a day on the East Coast Main Line. Open access was conceived as a way of using up marginal capacity on the rail network and providing services to places not adequately serviced by existing franchised operators. OAOs operate on a commercial basis with no subsidy. Heathrow Express and Eurostar can also be regarded as open access operators.

Rail fares and ticketing

- Around 45 per cent of UK rail fares are subject to regulation

- All other fares are set commercially by train operators which includes the use of price discrimination to increase fare revenues

- Government policy at present is that regulated rail fares should not rise in real terms

- The regulated fare increase in England for 2017 is 1.9% (based on an RPI +/-0 formula)

- Many passenger groups believe that the system of rail fare pricing is overly complicated and that it is too hard to find the best fare for a particular journey

Regulated and unregulated fares in the UK rail industry

Regulated fares are usually on commuter routes, where commuters have few practical alternatives to rail. Regulated fares are set by a formula based on the RPI figure for the previous July, and for many years with a degree of flexibility (called the ‘fares basket’ or ‘flex’).

Unregulated fares cover journeys where passengers have realistic alternatives to travelling by train and the market for transport is open to competition.

Source: UK Parliamentary Research Briefing (December 2018)

The case for nationalising the rail system

Supporters of nationalisation argue the following:

- The rail network is a natural monopoly where there are significant economies of scale from having one publicly-owned operator.

- Under state ownership, rail fares can be more tightly controlled and average fares lowered to improve the affordability of rail travel

- Profits from running the train network can flow to the Treasury and benefit all tax-payers. Train operating companies in the private sector pay routinely pay more than £200m a year in dividends to their shareholders

- The state can direct capital investment into the rail network on the basis of a social cost-benefit analysis. Investment will bring positive externalities and the state can take a longer-run view rather than the short-term approach of private companies that need to generate a return for their shareholders

- A state-owned rail industry could borrow more cheaply from the government than it could if it issued new debt to the bond market

- East Coast run by (state-owned) Directly Operated Railways (DOR) from 2009 until 2015 after two former private operators, first GNER then National Express, failed to meet their financial commitments is regarded as having run a good profitable service which delivered revenues to the Treasury.

- Nationalisation could take place on a gradual basis as each existing rail franchise comes up for renewal - this would lower the financial cost of a transfer of ownership

The case for having a privately owned and run train system

- It is possible to have genuine competition on some lines - e.g. Grand Central Trains, runs trains between Yorkshire and the North East of England and London in competition with Virgin Trains.

- Possible to improve the contest ability of the industry without a transfer of ownership e..g by allowing more open access operators to run train services

- Even if all profits made on the railways were reinvested in the railways, it would still require subsidy from the taxpayer

- Service standards have improved with privately-owned and operated rail services and there has been substantial investment in new rolling stock

- The Rail Delivery Group claim that in recent years, investment by the train operating companies has led to 5,700 new carriages, 6,400 more services a week and 180 stations improved. Private investment in the UK rail industry in 2016-17 was over £900m

- The history of state run railways in the UK has not always been good - in the 1970s and 1980s British Rail was heavily criticized for poor service standards and state-run organisations make lack the incentive to be productively efficient as they are less exposed to market forces.

Key economic concepts to consider as part of the rail nationalisation issue

- Economic efficiency - allocative, productive, dynamic

- Market failure - e.g. externalities associated with rail transport

- Regional economic balance - which rail users receive the highest subsidy per km travelled?

- Competitiveness - importance of having an efficient rail system including impact on tourism, attractiveness of the UK for foreign investment

- Drivers of demand for rail transport

- Capacity issues - elasticity of supply

- Economic and social arguments for providing a subsidy to rail users

- Pricing strategies of the train operating companies

Rail fare increase

In November 2018 it was announced that rail fares would increase by an average of 3.1% in 2019. This prompted widespread criticism from rail users and campaign groups already upset with falling train punctuality and over-crowded services. The Rail Delivery Group countered by saying that the vast majority of revenue from tickets is re-invested in the rail network.

I've been in Calculator Corner this afternoon. In the current decade rail fares have risen 37%, which is about one-third faster than the consumer prices index and twice the increase in average wages.https://t.co/KW3pgvRBX5

— Simon Calder (@SimonCalder) November 30, 2018

Money people pay in fares underpins investment in the better railway everyone wants. 98p of every pound from fares goes back into running and maintaining the railway. #investinginrail https://t.co/QTFbZsM0bF pic.twitter.com/KrGetB9wNX

— Rail Delivery Group (@RailDeliveryGrp) November 30, 2018

Rail fares to rise by 3.1% in January. Full story: https://t.co/cW5doWIX3m pic.twitter.com/I74yTgCbh1

— BBC Business (@BBCBusiness) November 30, 2018

Sources used and acknowledged:

Parliament Research Briefings

Department for Transport Statistics

You might also like

The Cross Rail Project

22nd September 2014

Cost Benefit Analysis - The Crossrail Project

27th April 2014

UK Productivity Gap Widens

20th October 2014

Growing Challenges Facing Privatised Royal Mail

17th October 2014

The Benefits of Choice: the Battle Never Ends

8th November 2013

Transport Economics - Electronic Road Pricing

11th October 2013