Study Notes

Ten Structural Problems Facing the UK Economy

- Level:

- AS, A-Level

- Board:

- AQA, Edexcel, OCR, IB

Last updated 22 Mar 2021

In one of our AS macro revision sessions we discussed some of the major structural problems facing the UK economy. Many of them are inter-related and require a combination of demand & supply-side policies to address them over time.

We raised and discussed the following:

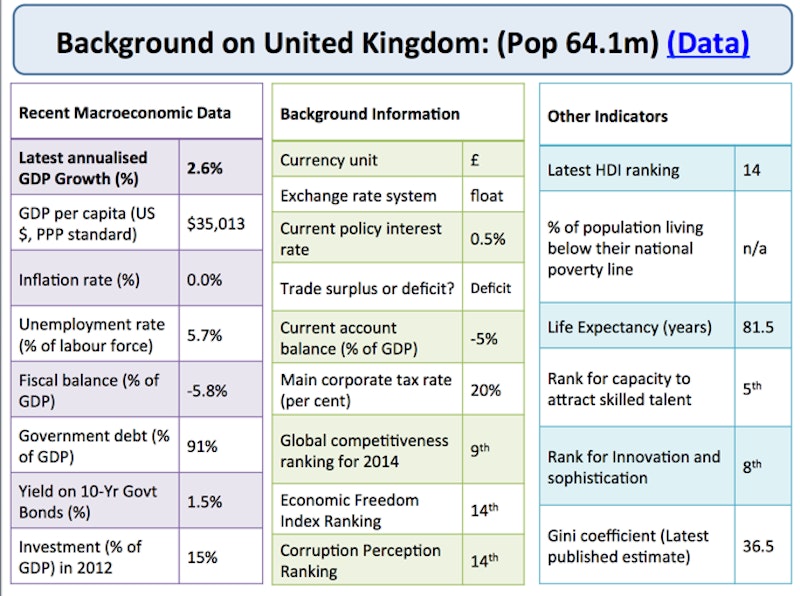

- Low business investment - capital spending as a share of GDP has fallen from around 20% in 2007 to less than 15% today. The government has a national infrastructure plan but the time lags involved in getting major projects up and running are long. The commercial banking system remains reluctant to finance the expansion plans of many small and medium-sized businesses. Low investment is a factor behind the next structural problem. Research and development remains persistently below 2% of GDP. Click here for revision notes on this topic

- Weak productivity growth - output per person employed has slumped in the UK and remains well below what would might have been expected more than five years into the recovery. There are many competing explanations for low productivity growth in the UK (referred to in some articles as the "UK productivity puzzle") click here for revision notes on this topic

- Structural unemployment - there has been a welcome and sustained fall in UK unemployment (currently 5.7% of the labour force), but deep-seated structural problems remain. More than 30% of those unemployed have been out of work for at least a year. Youth unemployment remains high and there are wide variations in regional unemployment / job opportunities across the regions of Britain. Click here for revision notes on this topic

- Structural decline in manufacturing - George Osborne wanted the present recovery to be a "march of the makers" but the evidence points to a weak rebound in manufacturing production, investment and jobs despite some notable successes such as car assembly in the UK. Britain continues to be heavily reliant on financial services. Click here for revision notes on this topic

- Structural trade deficit - the UK ran one of the largest current account deficits on record last year - the gap was more than 5% of GDP in 2014. Export growth in the recovery has been disappointing despite the UK enjoying a more competitive exchange rate. Click here for revision notes on this topic

- Structural fiscal deficit - the Coalition government has found it difficult to cut the size of the cyclically-adjusted budget deficit which remains above 5% of GDP. Weaker than expected tax revenues are a key part of the explanation, but a high budget deficit means that the national debt continues to rise in absolute terms and also as a share of GDP. Click here for revision notes on this topic

- Structural lack of competition in many markets - monopoly power in utilities such as electricity and gas has remained a topical economic and political issue. Fuel bills have been slow to declined despite the collapse int the world price of oil. A lack of real competition keeps prices high and affects the real incomes of millions of consumers, especially those on tight budgets. Click here for revision notes on this topic

- Structural inequality - one of the most important issues facing the UK at the moment. Real wages have been declining for a huge number of people; the real interest rates for pensioners reliant in savings have been negative. Executive pay continues to outpace the growth of average earnings by a huge amount. Click here for revision notes on this topic

- Structural problems in the housing market - the chronic under-supply of housing to buy and to rent is a major barrier to labour mobility. Why is the British economy unwilling/unable to make decisive progress in improving and expanding the housing stock? Click here for revision notes on this topic

- Structural under-funding of public services - economic, social and demographic pressures continue to mount on public services such as the NHS. Some economists argue that the NHS needs a major injection of extra funding over the next 5-10 years; others believe that there are many £ billions of savings still to be achieved by addressing inefficiencies in public health care. Click here for revision notes on this topic

This overview is not meant to be exhaustive but I hope highlights that, while Britain is enjoying a phase of relatively strong economic growth after a delayed recovery, there are underlying and often deep-rooted problems that need to be addressed.

The conventional view is that supply-side policies are most effective in tackling structural economic problems, but modern economies also need a sufficiently high level of aggregate demand to make efficient use of productive capacity and provide the momentum for businesses to invest. Thus the demand side effects of monetary and fiscal policy decisions remain important in this debate.

You might also like

UK Productivity Gap Widens

20th October 2014

Four facts about UK manufacturing industry

22nd October 2014

Immigration and the UK Economy

19th October 2014

Twin Peaks for the UK Economy

19th October 2014

Bank of England Chief Economist on the Real Economy

19th October 2014

Paul Ormerod: How sticky is unemployment?

23rd August 2013

Unemployment and hysteresis

10th February 2013