Study Notes

Mexico - Economic Growth and Development

- Level:

- AS, A-Level

- Board:

- AQA, Edexcel, OCR, IB

Last updated 22 Mar 2021

This study note covers aspects of economic growth and development in Mexico

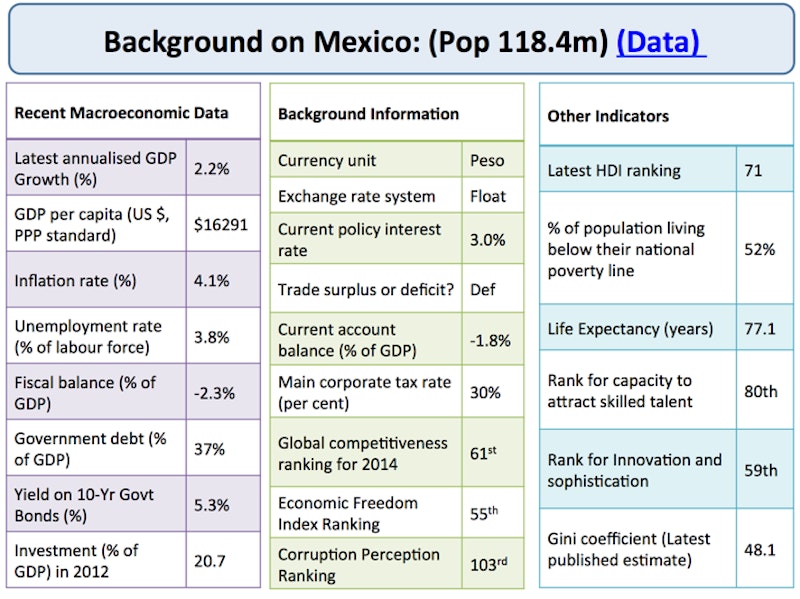

Key macroeconomic indicators for Mexico (Source: OECD)

Trade and Competitiveness

Over the years Mexico has established a number of free trade agreements with other countries. Indeed at the end of 2013, Mexico had 12 separate free trade agreements covering 44 countries. One of these is the North American Free Trade Agreement (NAFTA) that celebrates its 20th birthday in 2014.

Mexico is an open-economy, the value of trade in goods and services accounts for 64% of GDP. In absolute terms, the USA will remain Mexico's largest trading partner for decades to come. Close to 80% of Mexico's merchandise exports are currently destined for the USA. Mexico is also a founding member of the newly formed Pacific Alliance.

In the most recent World Bank “Ease of Doing Business" Report, Mexico was ranked 5th in the Latin American region with a world ranking of 54th. Brazil was down at 116th and Argentina 126. Chile was the highest-ranking country in the region with a global ranking of 34th. Mexico's macroeconomic environment has become increasingly stable over the past decades. This is viewed as favourable for the country's growth and development prospects in the medium term.

Fiscal policy

For almost two decades, Mexico has been running a small budget deficit, accompanied by a low level of public debt and a fiscal rule targeting a balanced budget. This is a clear indication of Mexico's prudent fiscal policy. Mexico's government income base is narrow, which is reflected by the fact that almost 60% of the workforce is not registered in the tax payment system. High levels of income inequality and informal economic activity have persisted for many years.

Economic growth

Mexico has struggled for three decades to raise trend growth rates. Despite a series of market-opening reforms, including the North American Free Trade Agreement, Mexico's real GDP growth has fallen behind that of other similar developing nations, both in Asia and in Latin America. As a result, GDP per capita and other improvements in living standards have stagnated.

Mexico has a serious productivity challenge that can be traced to what is often called the “two Mexico's"—a highly productive modern economy and a low-productivity traditional economy. The two Mexico's are moving in opposite directions: while the modern sector flourishes, competes globally, and raises productivity rapidly, in traditional Mexico (with very small, often informal enterprises), productivity is plunging.

- Productivity has grown 5.8% a year in modern firms but has fallen 6.5% a year in traditional firms

- Employees in traditional bakeries are 1/50th as productive as those in largest modern companies

- Manufacturing in Mexico is 24% as productive as in the USA, even though top plants exceed the US average

- The rapid expansion of the Mexican labour force due to population growth has 72 percent of overall economic growth since 1990 – this is now coming to an end

Since 1981, GDP growth in Mexico has averaged 2.3% a year. In 2012, the output of the average Mexican worker was about $17.90 per hour in purchasing power parity, still below the $18.30 per hour of 1981. Mexican GDP per capita, which was 12 times China's in 1980, is now only 25 percent higher, and, at current growth rates, China could surpass Mexico by 2018.

Mexico has become one of the world's top 15 global manufacturing economies (by gross value added) and one of the top five auto producers, with assembly plants of seven global automakers and operations of leading global parts suppliers. Annual production at the ten largest Mexican plants rose from 1.1 million vehicles in 1994, the year NAFTA went into effect, to nearly 2.9 million in 2012. Many Mexican plants are regarded as world-class, and some exceed average US productivity levels. Nearly 70 percent of the value of car exports from Mexico is based on imported parts.

You might also like

Growth and Development in the Ivory Coast

20th October 2014

Sugar Cane and Economic Development in Mauritius

20th October 2014

The Power of Remittances

19th October 2014

Slowing German economy must raise investment

19th October 2014

Growth and Development in Ethiopia

17th October 2014

Inequality and consequences for economic growth

6th October 2014

After the BRICs, the GIPSIs: Tackling Europe’s Problems

10th September 2014

Open Data - Britain leads the world

23rd July 2014